Jumpstart is a new approach to earthquake insurance for small businesses in California, Oregon, and Washington. We pay our customers a lump-sum immediately after a large earthquake, and the money can be used as-needed for recovery, whether or not there is physical damage. Your business can be more financially prepared for an earthquake with a Jumpstart policy.

Don’t be a statistic! 40% of businesses do not reopen after a natural disaster and another 25% fail within one year, according to the Federal Emergency Management Agency (FEMA). And yet small businesses employ 50% of Americans – they’re the lifeblood and backbone of our communities.

It is a common misconception that insurance payouts or government aid will be enough for businesses to recover after a major disaster like an earthquake. But earthquakes are excluded from many insurance policies, and government aid may be too little, too late.

With a Jumpstart policy your business will receive $20,000 immediately after an earthquake. This provides a financial cushion to lessen the shock of extra expenses, and it increases the chances that your business will survive, recover, and thrive.

What are the benefits of Jumpstart’s earthquake insurance for small businesses?

Jumpstart makes parametric insurance newly-available for small businesses. Features include:

- Fast payout

- Keep paying your expenses even if revenue temporarily drops

- Immediately replace lost inventory

- Begin repairs right away and prevent follow-on damage.

- Whether you lease or own your space

- Whether you buy conventional quake insurance or not:

- Jumpstart can be purchased as a stand alone policy. Many small businesses decline regular earthquake insurance because of the cost or the high deductible.

- You can buy Jumpstart even if your business already buys earthquake insurance. In this case, Jumpstart can help offset the large deductible or pay for expenses not covered by the other policy.

- Use the funds for any extra expense needed to recover, such as:

- Temporary relocation if you are unable to access the building

- Security measures

- Debris removal

- Repairs

- Continuing to pay rent or payroll even if revenue dips

How much coverage can we buy?

The amount of the lump-sum payment is either $10,000 or $20,000. It’s not enough to completely rebuild your business from scratch, but it does provide a jump-start!

Following a large earthquake that triggers a payout, your business would receive $10,000 or $20,000 right away, deposited automatically, to use for any expenses caused by the earthquake

Do you have other products available?

Yes! Our standard $10k policy can be bought by any renter, homeowner, or condo resident. We also have special products for:

- HOAs and property owners

- Real Estate agents

- Non-Profits and Schools

How can I buy Jumpstart earthquake insurance for my business?

For either a $10,000 or $20,000 policy, simply sign up on our website. This is also where you can see the cost of the premium, simply by entering your ZIP code. There’s a step in the sign-up where you click “business.” Be sure to include both the legal name of the business as well as contact information for the contact individual.

If you run into any problems, please call us at 510-891-1753. You can also ask your usual insurance broker to contact us.

Jumpstart is available in all zip codes of California, Washington, and Oregon, and is coming soon to other states.

What else?

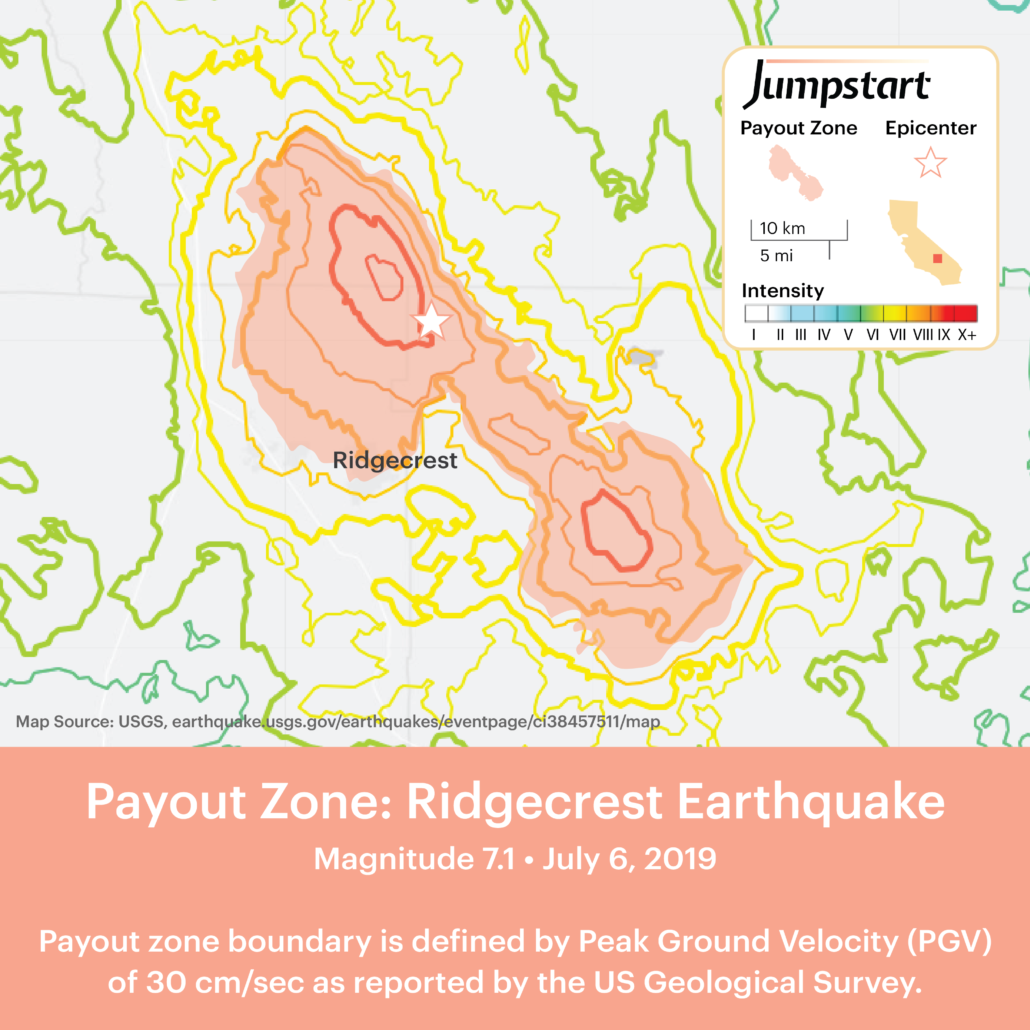

- Our parametric insurance is triggered by transparent public data from the USGS. Payouts occur when shaking intensity exceeds PGV 30 cm/sec, roughly equivalent to the ‘red zone ‘ of the USGS shake map. Read our post for more information regarding what would trigger a payout event.

- Customers in the payout zones are notified the day after the event. Once notified, customer responds with a simple text message to confirm that they have expenses.

- The full value of the policy is sent right away to begin recovery – Jumpstart has no deductible, claims adjusters, paperwork, or hassles.

- Jumpstart is available in all ZIP codes of California, Oregon, and Washington.

- Read our FAQs for more product information

- Read our Company Overview for additional information

Additional Resources for Business Disaster-Preparedness

Hungry for more? Here are some of our favorite resources for other ways to prepare your business for an earthquake or other disasters:

- Toolkit and other Resources for a Disaster-Resilient Business

- FEMA preparedness tips for Businesses

- Disaster Preparedness advice from the Santa Cruz Chamber of Commerce

Jumpstart Insurance Solutions Inc. – Regulated by and in full compliance with the California Department of Insurance.

Effected with certain Underwriters at Lloyd’s, London, A Rating by AM Best