Jumpstart has consistently received positive customer feedback since our launch in 2018. We also welcome opportunities to work with distribution partners.

This post is an addendum to Jumpstart’s Company Overview, providing additional details about our customers and partnership opportunities.

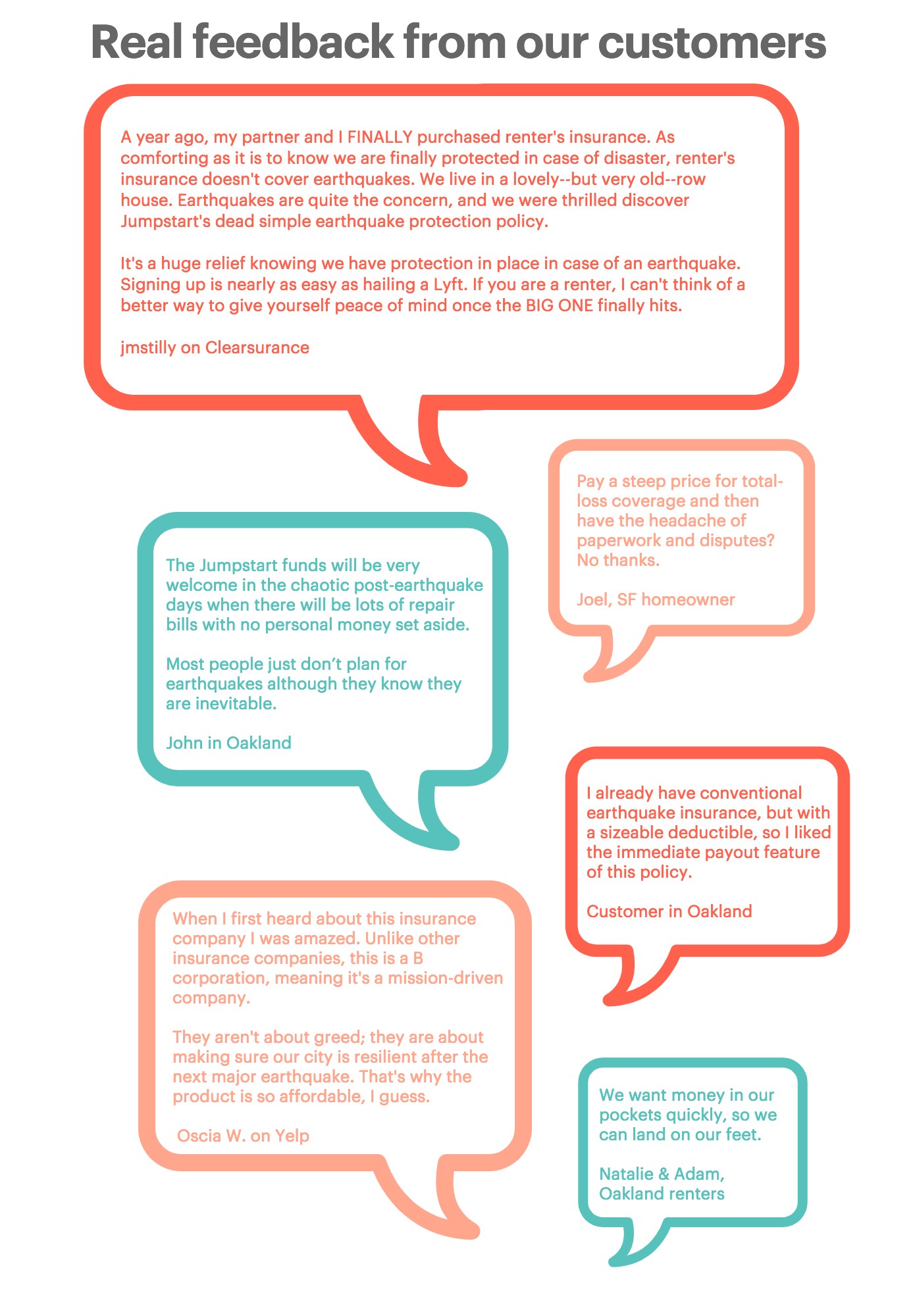

Check out Jumpstart’s fantastic customer reviews on Yelp and Clearsurance.

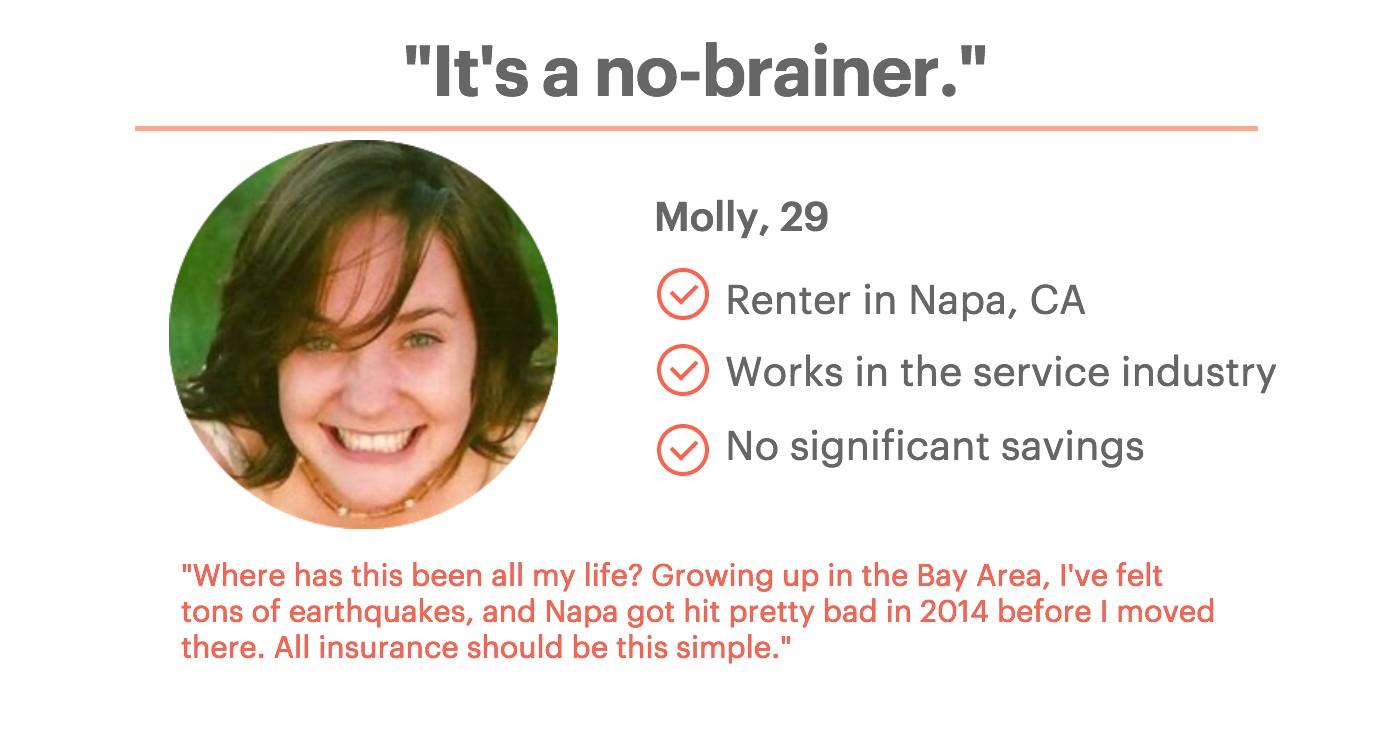

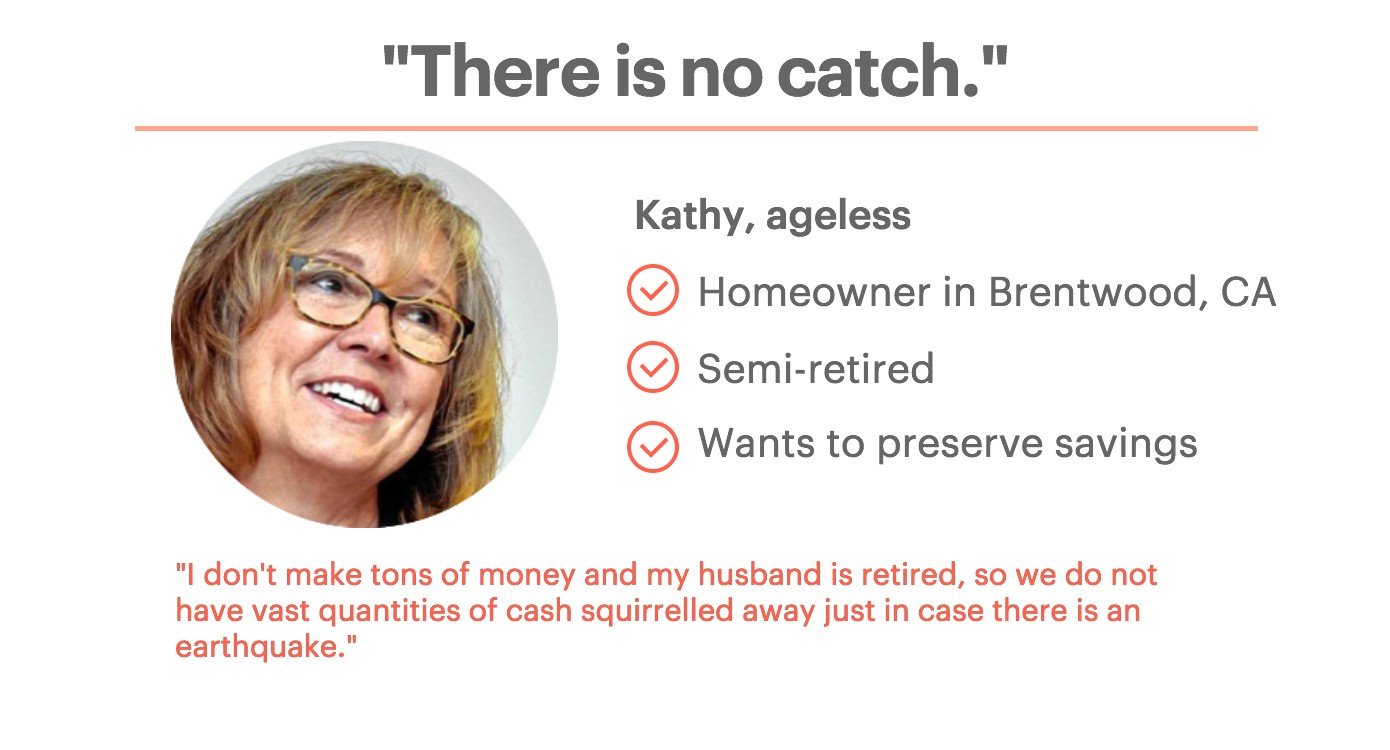

Our customers span the demographic spectrum. However, we’re seeing clusters of customers in two distinct segments. The common thread is that both segments think of Jumpstart relative to their finances:

- Millennials who are renters or condo owners and who haven’t accumulated much savings

- Nearing-retirement homeowners who don’t want to draw down their savings in a disaster

Here are real quotes from real customers in each of those segments:

Here are some more real quotes from real customers:

What’s most exciting is that more than 60% of our growth in digital-direct customers has come from word-of-mouth referrals. And, every time there’s an earthquake – large or small – we’ve seen a surge in new customers.

Distribution Partnerships

Jumpstart initially launched direct to consumer, but not at the exclusion of distribution partnerships.

We work with a variety of partners, from local real estate and insurance agents to other InsurTechs. Our favorite partnerships are when companies offering Jumpstart as an employee benefit. (Ask your employer for Jumpstart!)

If you’d like to explore how your company can work for Jumpstart, please contact us: call 510-863-4278, email info@jumpstartrecovery.com, or leave a message in the contact form below. We look forward to working together!