This post explains why Jumpstart exists and the change we’re trying to create in the world.

Natural disasters are devastating – not just in terms of damage, but financially, too. Jumpstart provides individuals and businesses a financial jump-start after the shock of a natural disaster.

No one, especially the uninsured, is ready for a disaster

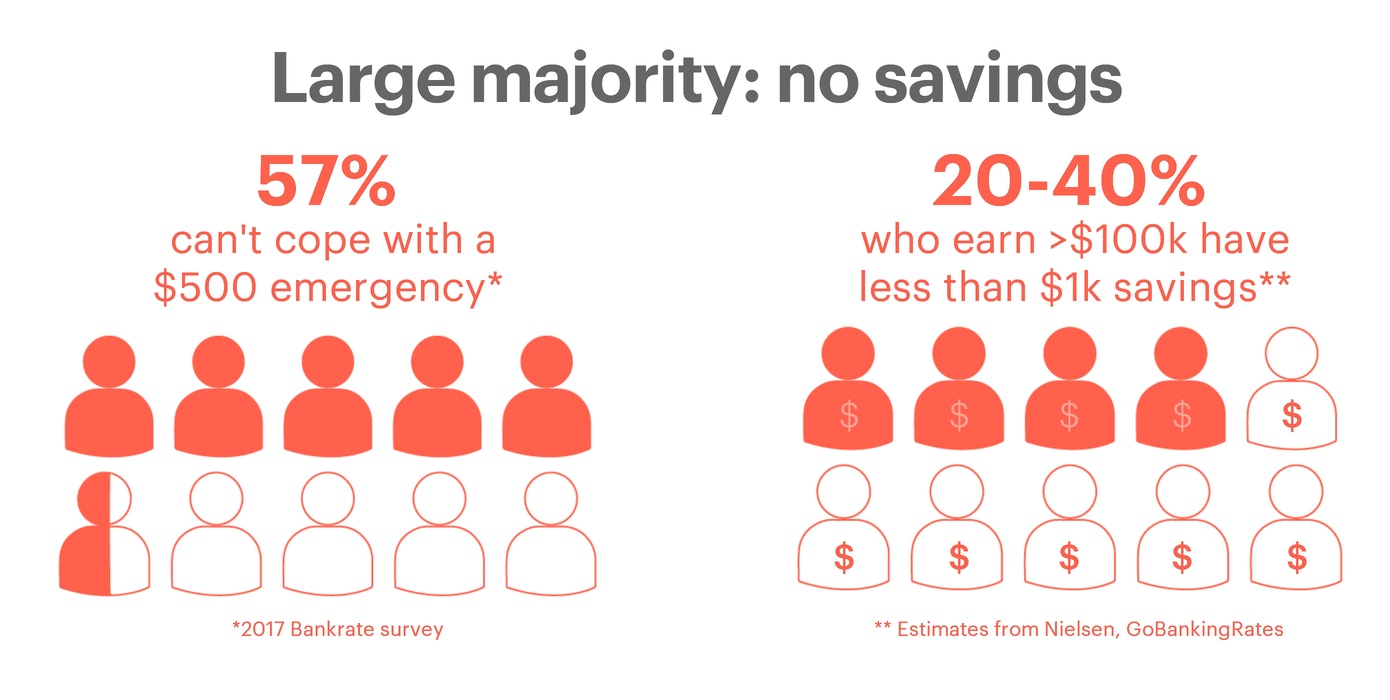

Nine out of 10 people have no financial cushion for severe disasters like floods and earthquakes, which are excluded from regular insurance. And government aid is often too little, too late.

But what’s worse? No savings. Most of us don’t have even $500 to cover a surprise expense, let alone the disruption of a natural disaster.

Insufficient or delayed funding can stall-out the rebuild process and even cause a local economy to implode. Jumpstart reverses this fate. Our immediate private-market cash infusion jump-starts recovery for individuals and whole communities.

Jumpstart gets more people protected

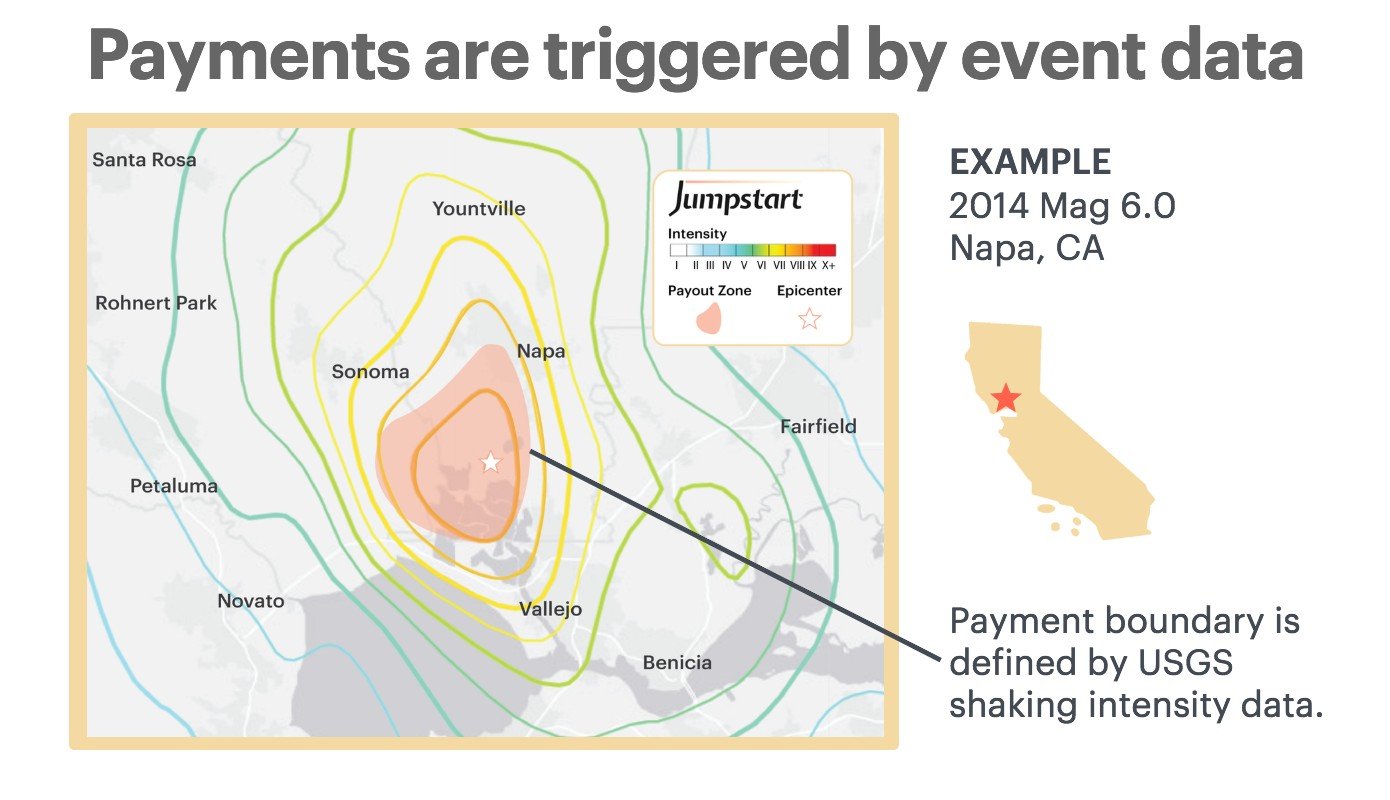

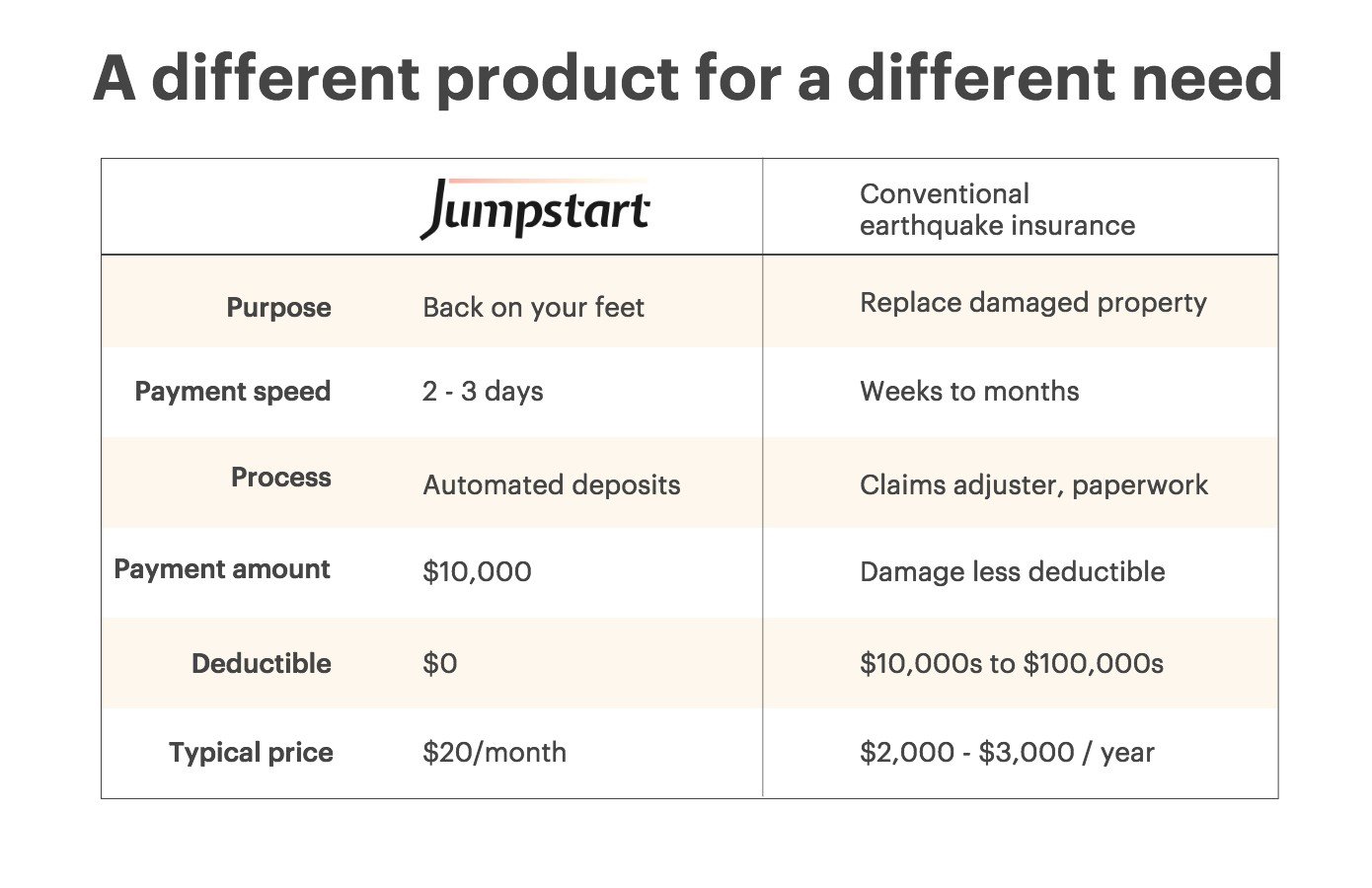

Jumpstart provides first-of-its-kind parametric insurance, with earthquakes in California, Oregon, and Washington. Our customers receive a lump-sum payment right away after a large earthquake via automated technology, whether or not they experience physical damage.

Jumpstart keeps what we all love about insurance – getting money when we need it – while eliminating what everyone hates: no delays, no paperwork, no deductible, no visit from an insurance adjuster.

By making disaster insurance simple, fast, and affordable, Jumpstart builds financial resilience for more people.

By making disaster insurance simple, fast, and affordable, Jumpstart builds financial resilience for more people.

Available Jumpstart products:

- $10,000 lump-sum for renters, homeowners, and condo residents

- $20,000 lump-sum for small businesses

- Employee benefit: customizable per-person lump-sum

- HOAs and property owners: customizable per-unit lump-sum

- Collaboration opportunities for:

- InsurTech Platforms

- Real Estate Agents

- Insurance Brokers

- Non-Profits and Schools

Company Facts:

2018: Initial product launched for California earthquake

2019: Product expansion to businesses and HOAs

2020: Launch for Washington and Oregon earthquake

Jumpstart is 100% underwritten by Lloyds, London, A+ AM Best Rating.

Notable investors:

- InsurTech Gateway

- individuals from Berkeley Angel Network

- crowd equity raise on Republic

A Team with the right Experience:

CEO: Kate Stillwell

- Licensed Structural Engineer, and past president of Structural Engineers Assoc. of N. CA

- former earthquake modeler at EQECAT (now CoreLogic)

- co-founder of GEM Foundation

- Stanford MS–engineering; Berkeley-Haas MBA

- A passion to build resilience

Selected Teammates:

- Sally Sproat: Over 30 years in re-insurance, specialty in selling parametric insurance to public entities and large organizations.

- Tena Melfi: Over 20 years in Insurance

- Alan Hampton

- Dee Pearson

What’s Next?

Jumpstart is on the forefront of creating a new product category – parametric insurance. Our goal is for parametric to become so widespread that “Jumpstart Policy” becomes a generic term for any coverage with fast, fixed payouts. As we expand from earthquakes to other hazards and other states, our long-term goal is to spur development of parametric insurance for disasters around the world.

Snapshot of Jumpstart customers

Our homeowner and renter customers span the demographic spectrum. Learn more about our customers: who they are and why they love us.

Building financial resilience through social impact

Jumpstart is a benefit corporation with the specific mission to get money in the hands of more people when they need it most. Learn how we’re measuring our social impact.