Jumpstart is first-of-its-kind earthquake insurance that allows real estate agents to provide clients with added peace of mind during the sales process and thereafter. We pay our customers a $10,000 lump-sum immediately after a large earthquake, and the money can be used as-needed for recovery, whether or not there is physical damage.

Buyers and sellers routinely ask their agents about earthquakes and what to do about them. Jumpstart can help you provide answers and ease your clients’ concerns.

Jumpstart has two unique ways of working with real estate agents to bring innovative parametric insurance to your clients:

- As a housewarming gift after closing

- As protection during the sales process

In addition, send your clients to our three-part series on how to read and interpret the earthquake disclosures when buying a home.

Jumpstart insurance during the Home sales process

Buying and listing agents are in a unique position to ensure a smooth purchase process. A Jumpstart policy can help prevent an earthquake from derailing the transaction and help your clients deal with the inevitable surprises of an earthquake.

Top agents are always looking to gain a competitive ‘edge,’ and Jumpstart is a novel solution that can help set you apart.

Benefits for Seller

- Homeowner can use the funds for any extra expense, including:

- Fix cracks, windows, and foundation

- Repair damaged pipes or water damage

- Cost of delays

- Loss of income

- Jumpstart can be used to offset the large deductible of traditional earthquake insurance

- Can be easily transferred into the buyer’s name for continued coverage at the same low monthly rate

Benefits for Listing Agents

- 90 days of earthquake coverage

- Show sellers that you are proactive and understand their worries

- Help prevent an earthquake from derailing the transaction

How does it work?

Jumpstart provides 90 days of coverage for home transactions. The policy is initially held by the seller and then transferred at no cost to the buyer, if escrow closes within the coverage period. Thereafter, the buyer will be given an opportunity to extend coverage at the same quoted rate.

Following a large earthquake that triggers a payout, your client receives $10,000 right away, deposited automatically, to use for any expenses caused by the earthquake.

What else?

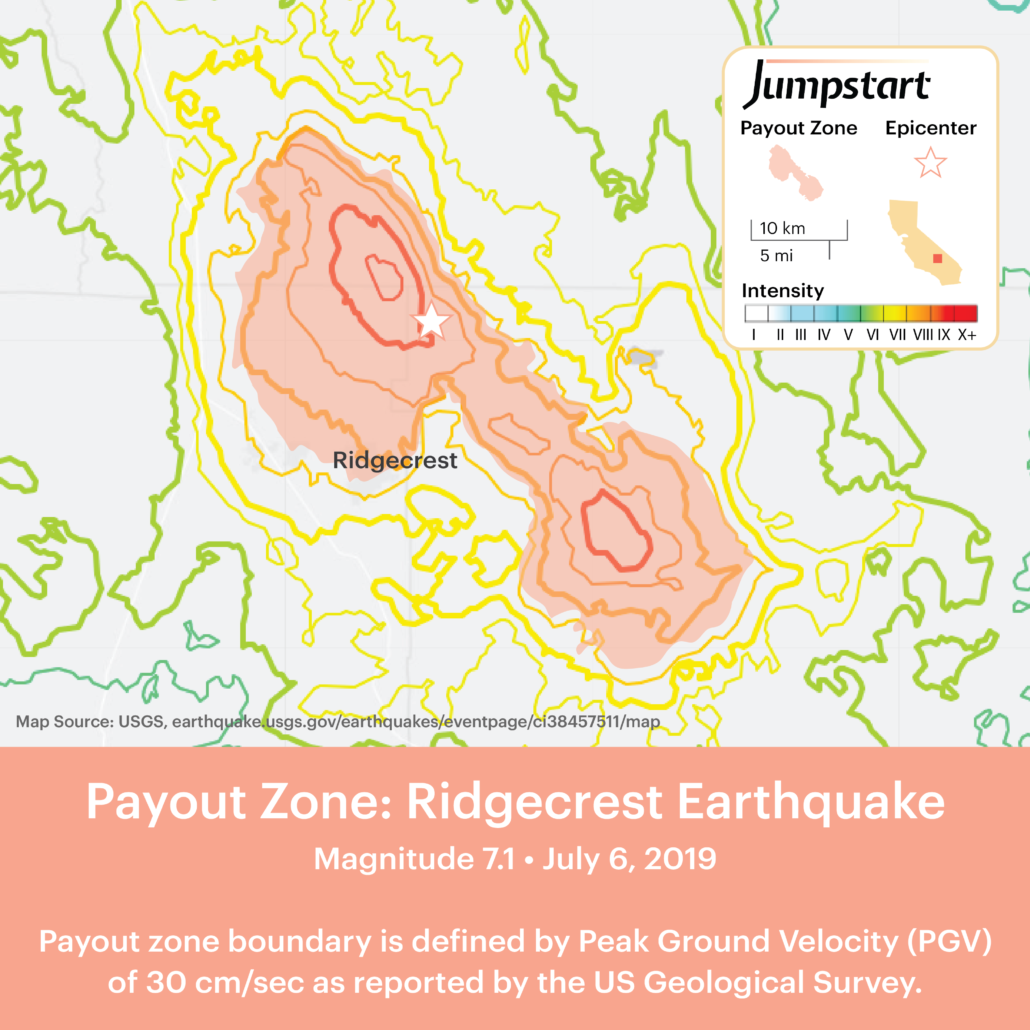

- Our parametric insurance is triggered by transparent public data from the USGS. Payouts occur when shaking intensity exceeds PGV 30 cm/sec, roughly equivalent to the ‘red zone’ of the USGS shake map. Read our post for more information regarding what would trigger a payout event.

- Customers in the payout zones are notified the day after the event. Once notified, customer responds with a simple text message to confirm that they have expenses.

- The full value of the policy is sent right away to begin recovery – Jumpstart has no deductible, claims adjusters, paperwork, or hassles.

- Jumpstart is available in California, Oregon, and Washington.

- Read our FAQs for more product information

- Read our Company Overview for additional information

Do you have other products available?

Yes! Our standard $10k policy can be bought by any renter, homeowner, or condo resident. This policy can be bought as a gift simply with the name, address, and contact information of the person receiving the gift.

We also have special products for:

- Small Businesses

- HOAs and property owners

- Non-Profits and Schools

How can I buy Jumpstart earthquake insurance?

Real estate policies are not yet available on our website but please use the contact form below, call us at 510-891-1753 or email us at info@jumpstartrecovery.com to purchase a policy.

Jumpstart is available in all zip codes of California, Oregon, and Washington, and is coming soon to other states.

Jumpstart Insurance Solutions Inc. – Regulated by and in full compliance with the California Department of Insurance.

Effected with certain Underwriters at Lloyd’s, London, A Rating by AM Best.